Understand and learn to calculate your net worth

What is your net worth?

Simply put, your net worth is what you own less what you owe. Or, in other words, calculate your net worth by summing the value of all your assets and then subtracting the sum of any liabilities you have. E.g. The total value of your house, your car, any savings or funds in your bank account, shares you own and any other assets, LESS any debts – e.g. your credit card debt, mortgage debt, short term loans or any other liabilities.

Just because someone has a high net income, that doesn’t mean that they have a high net worth. They could have a number of liabilities that reduce their net worth.

Who should calculate their net worth

It’s never too early to take the reins of your finances. Figuring out your net worth and closely monitoring it can give you the leg up you need to improve your financial future. You could look at your net worth figure as a report card that helps you evaluate your financial progression and ensure you are trending upwards over time. Anyone committed to achieving their financial goal should regularly calculate their net worth, including:

- Students

- Young professionals

- Parents

- Middle-aged workers

- High-income earners

- Retirees

Why it can help to understand your net worth

To get a better understanding of your personal finances, it’s can be very beneficial to get a solid understanding of your financial position. With a view of your net worth, you’ll understand your baseline and be able to get a better gauge on your current financial position. Better still, once you have your baseline, you’ll be able to track your position over time. Knowing your net worth is vital to:

- Understand your baseline and learn the true state of your finances.

- Determine if you have enough savings to cover emergencies.

- Better understand any debts you need to reduce.

- Track how you’re progressing over time.

- Inform your budgeting.

These are only some of the main benefits of calculating your net worth, but those alone indicate why financial advisors and analysts consistently use this wealth indicator.

How to calculate your personal net worth

There’s no major rocket science to this one. Instead, it requires that you take an inventory of everything you own and everything you owe. Once you’ve collated your list, determine the values of each asset and liability and subtract total liabilities from total assets.

Total assets – total liabilities = Net worth

Assets and liabilities to consider when calculating your net worth

When creating an inventory to calculate your net worth, these are some assets and liabilities to include:

Assets:

- Your savings balance in your savings accounts.

- The balance in your checking/current accounts.

- Balances in any retirement accounts you have created.

- Superannuation balance(s).

- The market value of your home (if you own one).

- If you own any investment properties, the market value of the property.

- The balance of any share investment accounts.

- The market value of any cryptocurrency, gold, art, jewelry, or any other alternative assets that you own.

- The value of any transportation assets you own – cars, motor bikes, boats, etc.

- Value of your ownership stake in any businesses you own, or part own.

Liabilities:

- The balance of any loan you have (mortgage, car loan, student loan, or any other loan).

- The value of any cash debt you may have.

- Any outstanding balance on credit cards.

- Tax liabilities you may have incurred that are outstanding.

- Any other debt you may have.

How often should you figure out your net worth?

Depending on your lifestyle, personal situation and financial goals, you might want to calculate your net worth monthly, quarterly or yearly. Both internal and external forces play a role in your net worth, so it is important to calculate your net worth consistently at a rate that suits your circumstances. Recalculating your net worth after incurring a big, once-in-a-lifetime expense that drastically affects this figure should also be considered.

If the process of how to calculate your personal net worth manually seems time-consuming and challenging, let us help you out. Humaniti can do it for you at the click of a finger!

How Humaniti can help

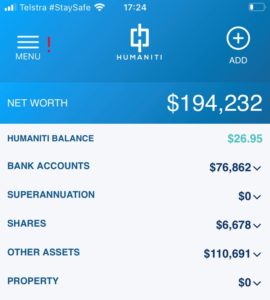

Humaniti’s personal finance and budgeting app can take the hassle out of calculating your net worth and tracking it over time. When you connect your financial accounts, the total values of your assets and liabilities will be automatically populated for you on your dashboard. If you have other assets or liabilities, you can add the values manually. Once all your assets and liabilities have been added, Humaniti will automatically calculate your net worth and track it over time.

Furthermore, Humaniti’s mission is to help you to build a brighter financial future by aiding you in:

- Understanding how you are spending.

- Discovering a 360° view of your finances.

- Comparing your Super to Australians like you so you can understand if you need to adjust your contributions to plan for a more comfortable retirement.

- Tracking your spending and subscriptions.

- Effortlessly earning extra cash by taking surveys.

Check out this article to learn more about how Humaniti can help you manage your personal finances.

If you are ready to calculate your net worth with minimal effort and take control of your financial future, download Humaniti today and sign up for our services. Have some questions? Read through our FAQs or contact us, and we’ll get back to you as soon as possible.

Disclaimer:

Humaniti is a personal finance and budgeting app, not a financial advise solution. This article is provided for general information purposes only. Consider seeking independent financial, taxation or other advice from a qualified advisor where you require assistance relating to your unique circumstances.