Understand where you’re spending to spend less and save more

When it comes to managing your personal finances, it’s essential to have a clear view of where your hard-earned cash is going.

An easy way to review your outgoings is to safely link your bank accounts through the Humaniti app and let us do the tracking and sorting for you. Each time a transaction occurs, the amount will be allocated to a category so you can see how much is being spent on items like transport, groceries, bills and lifestyle. You can drill down further to see the detail of each transaction or the category over a certain timeframe. If you are trying to stick to a monthly budget, aligning your monthly spend in real transactions is a great way to keep things balanced.

Transactions are automatically grouped into the most common categories and Humaniti’s smart tools also give you the option to manually create your own. To dig deeper into the detail, simply select the category you wish to review. For example, the Fees and Charges category will show you how much you’re paying in credit card interest and charges each month. Setting up your repayments to ensure they’re paid in time could save you hundreds of dollars in late fees over a 12-month period.

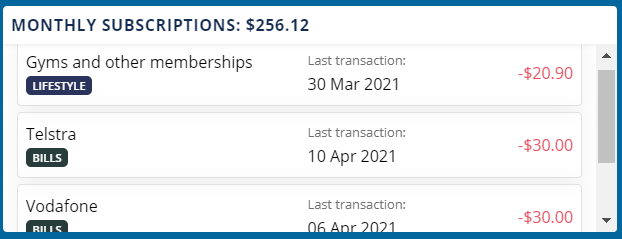

Another tip is to review the Subscriptions category to see if there are any recurring payments you may have forgotten about or services you no longer need. Eliminating just one magazine subscription or a fitness app you never use could free up extra cash to divert to your super account or another long term investment.

So what are you waiting for? Track your spending, grow your savings and get started on creating a brighter financial future.